A book for Indians starting on their investment journey

This is the 6th edition of the book, What Every Indian Should Know Before Investing. It’s a book that everyone who is about to start their investment journey should read, irrespective of their age. Along with investment options like FDs, RDs, NPS, Gold, NSCs, SCSS, PPF, EPF, Mutual Funds, Real Estate, Stocks, etc., this book also coversLife Insurance, Health Insurance, Writing a Will, and Making a Financial Plan, in detail. It has over 350 pages of detailed, up-to-date information about every topic relevant to the world of investing, explained in simple, jargon-free English. Read a sample chapter, go through the table of contents, or email me for more free chapters before you decide. Or simply head over to any offline or online store to buy a copy for yourself or for someone you think will benefit from this book.

Topics we've covered

The book covers almost every popular investment option available to you. Plus, topics around investments like insurance, writing a Will, and making a financial plan. Check out the topics, below.

Chapter 1

Tell me quickly about investing

Chapter 2

Women and investing

Chapter 3

basic investing terms and concept

Chapter 4

fixed deposit

Chapter 5

recurring deposits

Chapter 6

National Saving certificates (NSCs)

Chapter 7

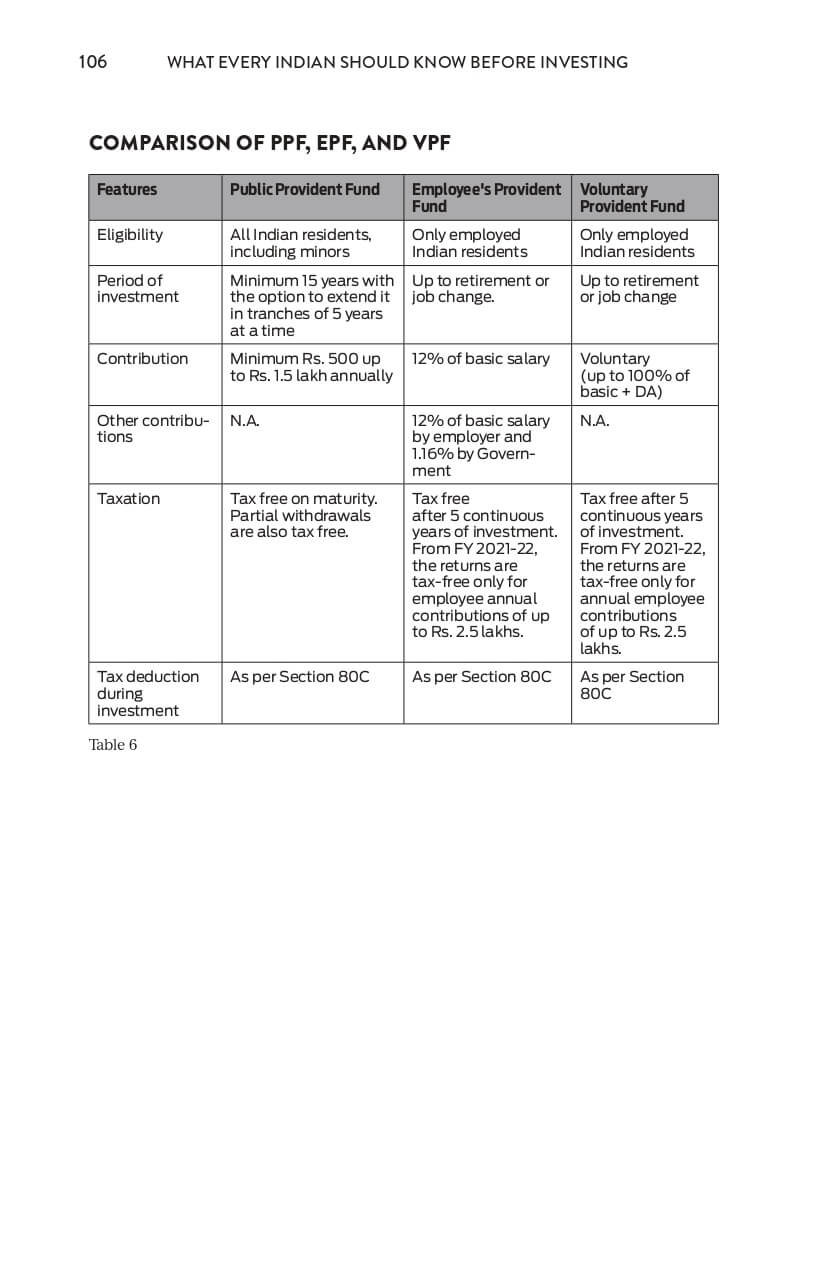

employees' provident fund (EPF)

Chapter 8

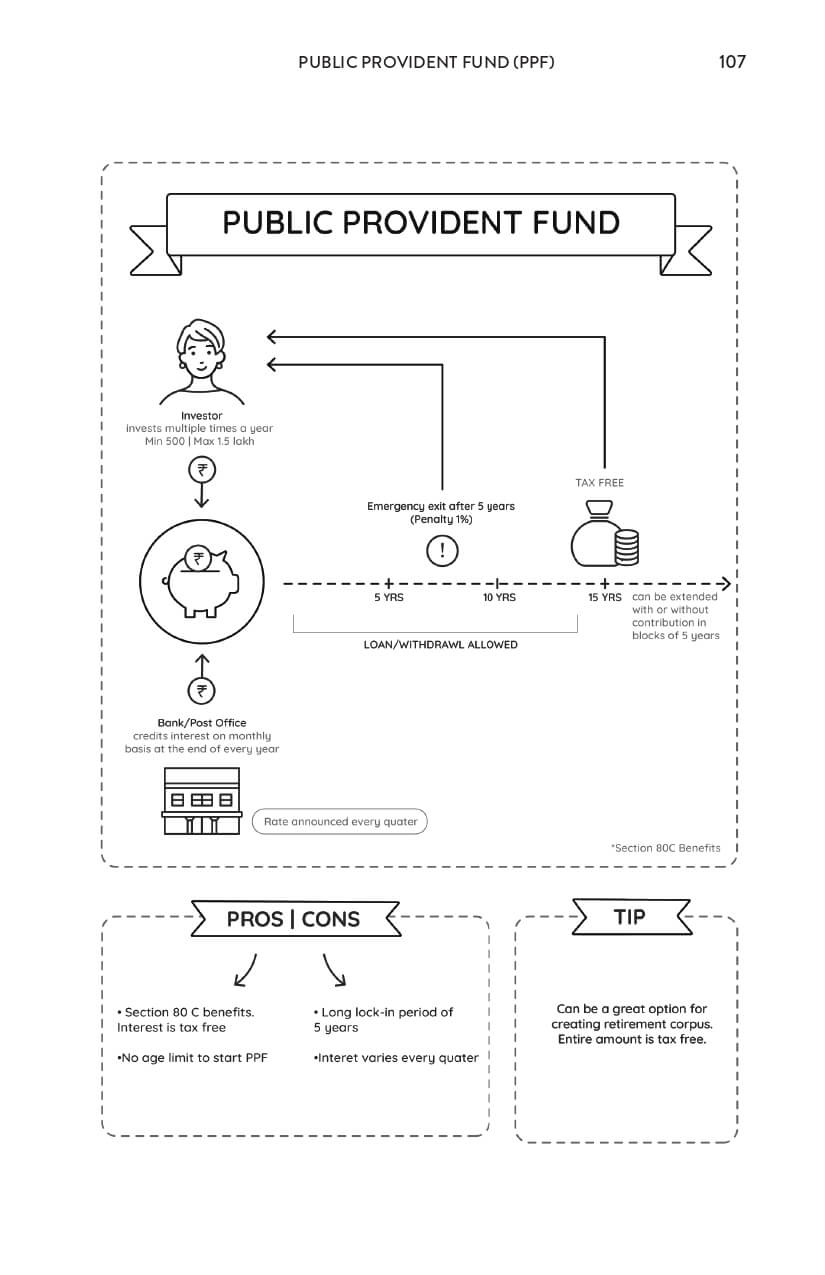

Public provident fund (PPF)

Chapter 9

National pension scheme (NPS)

Chapter 10

Life Insurance

Chapter 11

Health Insurance

Chapter 12

Gold

Chapter 13

Stocks

Chapter 14

Mutual Funds

Chapter 15

System investment plan(SIP)

Chapter 16

National Saving (Monthly Income Account) scheme

Chapter 17

Senior citizen saving scheme (SCSS)

Chapter 18

Real Estate

Chapter 19

Making a Will

Chapter 20

Other Investment options

Chapter 21

Making A financial Plan

Chapter 22

Reference for further reading

Review By Reader

Must read book for all the people. It gives a beautiful insight of all the financial aspects available in india.

The book goes through all the investment instruments that are available in India. A lot of options such as NPS, PPF, EPF etc could be covered entirely while options such as Stocks and mutual funds are covered in brief as they are very vast topics. Highly recommended read for personal finance.

This is one of the best financial, self-help book I have read till now for Indians. It covers the most important tooic that not many books cover for each investment strategy: Tax impact. Using the information provided for each investment option, each reader can make an informed financial plan. Quick tip: Keep a note pad with you when you read this and note down the action items and complete it after each chapter.

As the title says, it's a book full of financial wisdom in the Indian context. It's not an investment wisdom book, it's a proper financial planning guide. We have poor financial literacy in India and this is the kind of book which must be included in the high school curriculum. In some topics, more details would be better as it arises the curiosity in you but then, we have plenty of other resources to read after this.This is written in very basic english and with a lot of examples so almost everyone can understand each topic. A must read not only for investors but for every earning individual.

I think this is an extremely well structured book with good depth of the traditional investment options available in Indian markets. This book covers tax implications, liquidity issues and any caveats which one should be mindful of when considering these options. Never having a formal education in personal finance, I highly recommend this to anyone getting started with building some good and relatively safe investment options.

Goals give our lives Meaning

Latest Article

- May 18, 2023